|

Dictionary

Definitions

Expiry Date

Default settlement account

Securities Account

Tradable Quantity

Total Balance

Market Order

Limit Price Order

At-auction limit order

At-auction order

Stop Loss Limit Order

Price Spread handling

Odd Lot Order handling

Nominal Price

Expiry Date and Last Trading Date of Derivative Warrants

Expiry Date and Last Trading Date of Callable Bull/Bear Contracts (CBBC)

Volatility Control Mechanism

Inline Warrants

Leveraged and Inverse Products

Other Questions

Expiry Date

You can set a future date as the expiry date when you place an order. We will retry your order at the specified price from order date until expiry date.

Back

Default settlement account

It is the account that you specified during investment account opening for settlement purpose. Please be reminded to choose the default settlement account for all sale transactions if you have overdraft facility maintained in your account. Otherwise your orders will be rejected.

Back

Securities Account

It is the account number of your securities account. A securities account holds all your investments in all service channels (eg Internet banking service, Phonebanking, Branch, etc).

Back

Tradable Quantity

The maximum number of shares available to be sold.

Back

Total Balance

The number of total shares.

Back

Market Order

Market order is an order to buy/sell securities at the prevailing bid/ask price of the securities. The final execution price may differ from the nominal price at the time of order placement, especially for illiquid stocks and/or at the beginning of a morning and afternoon trading session due to orders accumulated during pre-market opening that need to be handled.

To help you better manage risk, the Bank will submit your market order to the market with one try only by matching it up to 10 best price queues at Hong Kong Exchanges and Clearing Limited (i.e. the prevailing best queue and up to the 10th queue at 9 spreads away at the time when the market order is processed) and up to a maximum of 20 spreads from the prevailing nominal price at the time your order is processed. Any unfilled quantity of your market order as a result of the above mechanism will automatically be cancelled right away. You are advised to check the order status to see if the market order has been fully executed or cancelled. If your order is not fully executed, you may wish to place another order.

Example (for illustration only)

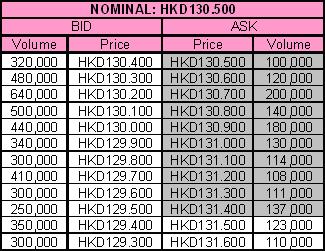

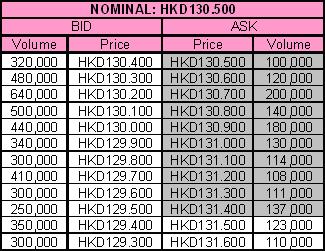

Customer A has placed a market order to buy 1,400,000 shares of Stock X. The prevailing nominal price is HKD130.50.

Under the condition that the Bank will match the market order up to a maximum of 20 spreads, the Bank will only execute the order when the price is HKD132.50 or below.

When the market order is submitted to the market, the Bank will match the order with the 10 best price queues. Referring to the queues in the table below, the Bank will execute the market order up to HKD131.40.

|

|

Trade executed:

100,000@HKD130.50

120,000@HKD130.60

200,000@HKD130.70

140,000@HKD130.80

180,000@HKD130.90

130,000@HKD131.00

114,000@HKD131.10

108,000@HKD131.20

111,000@HKD131.30

137,000@HKD131.40

Unfilled quantity:

60,000 shares cancelled |

|

As the order quantity is 1,400,000 shares, the Bank will execute the market order by buying all 1,340,000 shares in the 10 price queues. The unfilled quantity of the order (60,000 shares) will be automatically cancelled. If Customer A would like to buy the remaining unfilled quantity, he will need to place another order.

Back

Limit Price Order

An order in which you specify your highest purchase price or lowest selling price. A limit order will be monitored by the Bank's system and passed to the SEHK for processing once it falls within the 24 spread range of the current market bid/offer prices. This processing mechanism is subject to change at the Bank's discretion without prior notice. Please note that we do not accept limit price for odd lot trading, please select Market Order if you wish to trade an odd lot.

For stocks eligible for Closing Auction Session, outstanding orders in the SEHK at the end of Continuous Trading Session will be automatically carried forward to Closing Auction Session if it is within the price limit.

Back

At-auction limit order

At Auction limit order is a limit order valid for the Pre-opening Session and Closing Auction Session. You can conveniently place an at-auction-limit order any time through HSBC Internet Banking except from 9:22am to 4:01pm on Hong Kong trading days. Multiple day order is not allowed for At Auction limit order.

Pre-opening Session (9:00am - 9:30am)

Input for At-auction limit order is allowed in Pre-opening Session from 9:00am to 9:22am provided that the order is within the acceptable price limit. Please refer to the table below for the arrangement of order input, cancellation and amendment and price limit in the Pre-opening Session.

| Time |

9:00am - 9:15am |

9:15am - 9:20am |

9:20am - 9:22am |

9:22am - 9:30am |

| Session |

Pre-opening Session |

| Order Input Period (15 mins) |

No-cancelation Period (5 mins) |

Random Closing Period (0- 2 mins) |

Blocking Period (8-10 mins) |

| Description |

Price Limit*:

+/- 15% of Previous Closing Price (except for newly listed stock, stocks resuming from trading suspension) |

Within lowest ask & highest bid (recorded at the end of order input period) |

Unfilled at-auction limit orders will be carried forward to CTS as limit orders if it is within the price limit |

Order Type Allowed:

At-auction Order, At-auction Limit Order |

| Order Input, Cancellation & Amendment: |

| Input, Cancel & Amend allowed |

Input Allowed, Cancel & Amend Not Allowed |

* Price Limit is +/-15% of previous closing price or the adjusted closing price for securities that have undergone corporate actions (except for newly listed stock, stocks resuming from trading suspension). For listing day of ETFs and L&I Products, pre-IPO net asset value per unit (NAV) will be used as the POS reference price for price validation.

Note:

- Only eligible stocks can participate in the Pre-opening Session: all equities (including depository receipts, investment companies, preference shares and stapled securities), funds (including Exchange Traded Funds (ETFs) and REITs) and leveraged and inverse products (L&I Products). Please refer to the HKEx website for eligible stocks list.

- Auction matching ends randomly within the 2-minute period from 9:20am to 9:22am, randomly determined by the HKEx's system.

Please note that orders accepted by the Bank may nevertheless not be supported by the HKEx's AMS/3, such as at-auction limit orders with order price lower than HKD0.01 or deviates 9 times or more from the previous closing price, and accordingly, such orders will not be executed.

For the pre-opening session, any unfilled at-auction limit orders at HKEx will be converted to limit orders and carried forward to the Continuous Trading Session if it is within the price limit.

To protect our customer's interest, a message will be displayed to remind you to double check input price should your at-auction limit price deviates from the last price of previous trading session by 15% or more, except for scenarios where no previous closing price is available such as newly listed stocks.

To help you better capture market opportunities, if the HKEx's Pre-opening Session is cancelled due to typhoon, Black Rainstorm Warning or any other reasons, the Bank will convert your at-auction limit order to normal limit order and place it in the Continuous Trading Session when HKEx resumes trading during the same trading day. If no trading is resumed on the same trading day, those at-auction limit order placed will not be executed.

Closing Auction Session (4:00pm to 4:10pm)

Input for At-auction limit order are allowed in Closing Auction Session from 4:01pm to 4:10pm provided that the order is within the acceptable price limit. Please refer to the table below for the arrangement of order input, cancellation and amendment and price limit in the Closing Auction Session.

| Time |

9:30pm - 12:00noon

1:00pm - 4:00pm

|

4:00pm - 4:01pm |

4:01pm - 4:06pm |

4:06pm - 4:08pm |

4:08pm - 4:10pm |

| Session |

Continuous Trading Session |

Closing Auction Session |

| Reference Price Fixing Period (1 min) |

Order Input Period (5 mins) |

No-cancelation Period (2 mins) |

Random Closing Period (2 mins) |

| Description |

Reference price based on the median of 5-snapshot nominal prices in the last minute of Continuous Trading Session |

- Calculate & publish reference price

- No Input, Cancel & Amend

- Orders within price limit will be automatically carried forward

|

Price Limit:

5% of Reference Price |

Within lowest ask & highest bid |

Order Type Allowed:

At-auction Order

At-auction Limit Order

|

| Order Input, Cancellation & Amendment: |

| Allow Input, Cancel & Amend |

Input Allowed, Cancel & Amend Not Allowed |

Note:

- Only eligible stocks can participate in the Closing Auction Session. Please refer to the HKEx website for eligible stocks list.

- Auction matching ends randomly within the 2-minute period from 4:08pm to 4:10pm, randomly determined by the HKEx's system.

- For half day trading, the Closing Auction Session will be from 12:00noon to 12:10noon.

Please click here for further information

Back

At-auction order

An at-auction order is an order with no specified price valid for the Pre-opening Session and Closing Auction Session. You can conveniently place an at-auction order from 9:00am - 9:20am, and 4:01pm - 4:10pm through HSBC Internet Banking on Hong Kong trading days.

Pre-opening Session (9:00am - 9:30am)

At-auction order enjoys a higher order matching priority than an at-auction limit order. If At-auction order is matched, the execution price will be the final Indicative Equilibrium Price (IEP)*. Please note that the execution price of At-auction Order may substantially deviate from the stock price at the time you submitted the order.

Please refer to the table set out under "At auction limit order"/ "Pre-opening Session" above for the arrangement of order input, cancellation and amendment applicable to "At-auction order" in the Pre-opening Session.

Any outstanding at-auction orders after the end of the Pre-opening Session will be cancelled before the commencement of the Continuous Trading Session.

Closing Auction Session (4:00pm - 4:10pm)

At-auction order enjoys a higher order matching priority than an at-auction limit order. If At-auction order is matched, the execution price will be the final Indicative Equilibrium Price (IEP)*. Please note that the execution price of At-auction Order may deviate from the stock price at the time you submitted the order.

Please refer to the table set out under "At auction limit order"/ "Closing Auction Session" above for the arrangement of order input, cancellation and amendment applicable to "At-auction order" in the Closing Auction Session.

* Indicative Equilibrium Price (IEP) refers to the price where the maximum number of shares can be traded if order matching occurs at that time. Please refer to the HKEx website for detailed definition.

Please click here for further information

Back

Stop Loss Limit Order

An instruction that is automatically triggered when the Nominal Price of the stock drops to or below the Stop Loss Price set by the Customer. Once triggered, it becomes in effect an order to sell at a price at or higher than the Lowest Selling Price set by the Customer. This type of order can be used to help manage the market risk on your stock portfolio. Please also note the following:

- Customers can setup the order with the criteria:

- The Stop Loss Price should be within 200 spreads below the nominal price; and

- Stop Loss Price >= Lowest Selling Price >= HK$0.01.

- Orders with (i) odd lots, (ii) non-HKD stocks feature are not acceptable for Stop Loss Limit Orders.

- You can place "Stop Loss Limit Order" valid for 7 calendar days. However, if the Stop Loss Limit Order is triggered before the expiry date, it will expire at the close of the trading date on which it is triggered regardless of whether it is executed fully, partially or even not executed at all. You are advised to check the updated order status via "Order Status Screen" and can then consider to setup another order, if necessary.

- Stop Loss Limit Orders may be triggered in the Pre-opening Session, but will only be submitted to the market in the Continuous Trading Session.

- Once the Stop Loss Limit Order has been triggered, there is a risk that it may be executed at a price above the Stop Loss Price, if the stock price bounces back quickly.

- Depending on the market conditions, there is potential risk of failing to execute the Stop Loss Limit Order by the bank even if the price of the respective stock has hit the specified triggering level.

- Stock codes with larger numbers may well be subject to later execution than those with lower numbers which may result in a lower or higher execution price.

- Amendment of Stop Loss Limit Order is not permitted. If you want to modify a Stop Loss Limit Order, you are required to cancel it first and then setup another Stop Loss Limit Order or other orders.

Back

What will be the handling for execution when, having submitted the order instruction to the bank and the order has not expired, the order price does not match the relevant spread table (due to the spread table having changed)?

The bank's broker may send the relevant order to the Stock Exchange of Hong Kong for execution with the price at the best nearest acceptable spread.

Back

What is the handling of odd lot orders?

We cannot process an order consisting of both board lot and odd lot portions. To proceed, you will need to place two separate orders as follow -

Order 1: For board lot portion, with quantity as a multiple of the board lot size; and

Order 2: For odd lot portion, with quantity less than one board lot size.

Please note fees and charges apply to each separate transaction.

For odd lot trading, we only accept Market Order and due to manual processing of odd lots orders, such orders may take longer to process. All odd lot shares will be traded at the prevailing odd lot market prices which may be less favorable than the normal market prices.

Odd lot trading is not allowed for derivative warrants, Callable Bull/Bear Contracts and Inline Warrants.

Back

Nominal Price

"Nominal Price" means as per the definition in the Rules of the Exchange at any time during or at the close of the pre-opening , continuous trading sessions or closing auction session, the previous closing price, the indicative equilibrium price, the current bid price, the current ask price or reference price depending on whether or not the specified stock has been traded up to that time on the day under the various circumstances as set out in the definition. Please refer to the website of The Stock Exchange of Hong Kong Limited for the Rules.

Back

Expiry Date and Late Trading Date of Derivative Warrants

The expiry date of a derivative warrant is not the same as the last trading date. To ensure that a trade executed on the last trading date has sufficient time for settlement and registration, the last trading date is 4 trading days before the expiry date. Investors can only trade the derivative warrant on or before the last trading date.

Back

Expiry Date and Last Trading Date of Callable Bull/Bear Contracts (CBBC)

The expiry date of a CBBC is not the same as the last trading date. The last trading date of a CBBC is 1 trading day before the CBBC expiry date or the day that the CBBC is called by its issuer (if it is called before expiry date.)

Back

Volatility Control Mechanism

What is Volatility Control Mechanism (VCM)?

HKEX introduced the VCM on 22 Aug 2016. The VCM is triggered if abrupt price volatility is detected at an individual stock level. If a VCM is triggered, a 5-minute cool-off will ensue (except for circumstances laid out below), during which the VCM security can continue trading but will only be allowed to trade within a pre-defined price band. Please visit HKEX website for details.

What stocks are covered under the VCM?

VCM will only be applied to the constituent stocks of All Hang Seng Composite LargeCap, MidCap and SmallCap Indexes. Please visit HKEX website for the stock list.

How will VCM be triggered?

The monitoring period of VCM is applied to continuous trading sessions (CTS), except the first 15 minutes of the Morning and Afternoon CTS, and the last 20 minutes of the Afternoon CTS. The VCM is triggered if the price of a VCM in-scope security deviates by more than ±10%,±15%,±20% for Hang Seng Composite LargeCap, MidCap and SmallCap Indexes constituent stocks respectively away from the last traded price 5-min ago during the monitoring period. Once the relevant thresholds are reached, a 5-min cooling-off period will start. Multiple VCM triggers per trading session are allowed to better safeguard market integrity, i.e. there will be no maximum number of triggers imposed.

What can I do if VCM is triggered?

During the cooling-off period, trading is allowed within a pre-defined price band. Normal trading without restrictions will resume after the cooling-off period. You can check the start/end time of cooling-off period and the pre-defined price band in Personal Internet Banking, Stock Express, Mobile Banking and Easy Invest.

Will my order be rejected when VCM is triggered?

If the potential trade price of your relevant order (according to the respective order type, e.g. limit order, market order and stop loss order) placed by the broker to HKEx is outside the pre-defined price band during the cooling-off period, your order will be rejected and the order status will become 'unexecuted' or 'Dealing to be resumed on next trade day' (for order not yet expired).

For example, your market order with 1 day expiry will be rejected and 'unexecuted' when the potential trade price of the relevant order placed by broker with one try only (matched up to 10 best price queues and up to a maximum of 20 spreads from the prevailing nominal price) is outside the VCM pre-defined price band.

You are advised to check the latest order status via "Order Status Screen" and may consider setting up a new order, if necessary.

Back

Inline Warrants

Where can I check the upper/lower strike price of an Inline Warrant?

You may login to HSBC Personal Internet Banking-> My investments -> Market information to enquire upper/lower strike price of an Inline Warrant. (Or stock price quote in HK Stocks of StockExpress) Alternatively, you may also visit HKEx website stock price quote or respective issuer's website for detailed information of an inline warrant. Customer is reminded to read and understand product Key Facts Statement and product documents of the listed Product before investing.

Can I trade inline warrant at above HKD1.00?

Due to the pre-determined fixed maximum payment at expiry of HKD 1.00, an inline warrant should not be traded above HKD 1.00.? Investors will suffer a loss by buying an inline warrant above HKD 1.00

What will happen if my Inline Warrant order is executed above HKD 1.00?

The Exchange announced that any trades of inline warrants which are executed at the price above HK$1.00 shall not be recognized. Trades will be cancelled on T day, but those executed near 4 p.m. market close may be cancelled on the next trading day (T+1). The bank will notify you about the order cancellation at best effort. Order status of your order will be updated from "Fully Executed" or "Partially Executed" to "Unexecuted".

Please note if you buy an inline warrant above HKD 1.00 and then sell it below HKD 1.00 before settlement of the inline warrant. Your buy order will be cancelled by the Exchange but you need to buy back from the market to settle your sale order.

How can I place an inline warrant order?

You can place inline warrant order via HSBC Personal Internet Banking, Stock Express, Mobile Banking, Easy Invest, Manned/Automated Phonebanking and also branches (if applicable).

Back

Leveraged and Inverse Products

How can I place an order of Leveraged and Inverse Products?

You can place an order of Leveraged and Inverse Products via HSBC Personal Internet Banking, Stock Express, Mobile Banking and Easy Invest.

Back

Other Questions?

Is there a time limit on the sell order?

You can set a future date as the expiry date when you place an order. We will retry your order at the specified price from order date until expiry date.

Can I sell a stock I bought today?

Yes. You can sell the scrip receivables before settlement.

Can I place securities orders any time?

HSBC Internet Banking:

Yes, you can place orders via HSBC Internet Banking 24 hours a day, 7 days a week. Details are provided below.

- From 9:30am to 12:00noon and 1:00pm to 4:00pm on Hong Kong trading days, you can place a market order.

- You can place a Limit Price Order, Stop Loss Limit Order, Two-way Limit Order and Target Buy Sell Order at any time (except from Closing Auction Session (4:00pm-4:10pm)), and an At-auction limit order at any time (except from 9:22am to 4:01pm) on Hong Kong trading days.

For the pre-opening session, any unfilled at-auction limit orders at HKEx will be converted to limit orders and carried forward to the Continuous Trading Session if it is within the price limit.

- You can place an At-auction order from 9:00am-9:22am and 4:01pm-4:10pm on Hong Kong trading days.

Investment Phonebanking Services (both manned and automated channels):

| Limit Price Order, Stop Loss Limit Order, Two Way Limit Order and Target Buy Sell Order: |

8:00 am-4:00 pm on Hong Kong trading days |

| At-auction-limit order: |

8:00am-9:22am, 4:01pm-4:10pm on Hong Kong trading days. |

| At-auction order: |

9:00am-9:22am, 4:01pm-4:10pm on Hong Kong trading days. |

| Market order: |

From 9:30am to 12:00noon and 1:00pm to 4:00pm on Hong Kong trading days

|

Not all my stocks are listed. Why?

This list only shows stocks that are available for trading through Internet banking service. For holdings(if any) of delisted securities, you may refer to 'Other Investment' or your investment services/Securities account statement.

Can I amend or cancel my order?

You can always amend or cancel your order in the order status enquiry screen. However, this will be subject to the status and type of your order. If your order has been executed, no amendment or cancellation will be allowed.

Are the shares trading instructions ("orders") placed via The Hongkong and Shanghai Banking Corporation Limited being processed by straight-through securities trading services?

All your orders placed via any of the available channels at The Hongkong and Shanghai Banking Corporation Limited will be processed by straight-through securities trading services, except under the following conditions where orders may be processed manually:

- When you place market orders

- Buying/Selling of odd lots

- A single order with quantity exceeding 3000 board lots

- Price per share is lower than HK$0.01

- Your purchase price is higher than the market prevailing ask price/Your selling price is lower than the market prevailing bid price. In the case of Nasdaq-Amex Pilot Program securities, where your purchase price is higher than the last closing quoted in the US market / traded price quoted in the Hong Kong market or your selling price is lower than the last closing quoted in the US market / traded price quoted in the Hong Kong market.

Will my stock order not be submitted / delayed for execution in the exchange under pre-trade checking by the broker?

We may send your orders for listed securities to brokers for execution. They may perform pre-trade checking before submitting your orders to the relevant Exchange. Whenever the relevant broker determines that it is appropriate and in the interest of a fair and orderly market and comply with applicable local regulation/exchange trading rules/market requirements, without prior notice to you, the brokers may hold your orders or not execute your orders at all.

In situations where we need to contact you to confirm the order details, we will hold your order until clarification is obtained.

Please check your latest order status through the 'Order Status' enquiry after you have placed a new order, an amendment or a cancellation instruction. Order status will be 'unexecuted' or 'Dealing to be resumed on next trade day' if your orders are not executed.

How can I find out the status of the orders I placed last month?

Just select the dates (up to last seven calendar days) and transaction type you wish to review for Show History. You may also type the stock code for filtering the orders.

What happens if the limit order input price is higher for buy order (or lower for sell order) than the market price?

The Bank's broker may execute your order at a price closer to the market price, if the market conditions allow. The executed price(if happens) may be better than your specified input price subject to market conditions

What are the possible order statuses?

- Fully Executed: all order quantity is executed upon the order expiry date.

- Partially Executed: part of the order quantity is executed upon the order expiry date.

- Unexecuted: order cannot be executed upon the order expiry date.

- Fully Cancelled: request of order cancellation is accepted by broker (without partial executions).

- Partial Cancelled: request of order cancellation is accepted by broker (with partial executions).

- Pending Amendment: pending for broker's acceptance for the request of order amendment, no further amendment/cancellation is allowed.

- Pending Cancellation: pending for broker's acceptance for the request of order cancellation, no further amendment/cancellation is allowed.

- Pending Dealing: pending for order execution.

- Pending Capture: orders received after business hours and pending for validity checking. For orders with "pending capture" status, customers must check whether such orders have been successfully captured by the Bank with a "pending dealing" status or rejected due to insufficient funds or other reasons before 9:30 am on the next business day.

How am I notified of my order status and execution results?

You can check your order status and execution result on the Order Status screen via HSBC Internet Banking. We will also send you an email of the execution result.

Alternatively, you may sign up for our free eAlerts investment order confirmation service at HSBC Internet Banking to receive your stock order execution result via SMS. For more details about eAlerts, please go to our Manage eAlerts.

Why am I unable to sell my purchased shares that are undergoing a stock Split/Consolidation corporate action via automated channels such as HSBC Internet Banking?

Since the purchased shares are not yet settled and cannot be converted into the temporary stock code used during the parallel trading period, you cannot place the sell order of the stock using the temporary code via automated channels before settlement of the purchased share (on T+2). For assistance on placing sell order, please contact our Phonebanking Hotline for assistance.

Why am I unable to sell my purchased shares that are undergoing a transfer of listing from the Growth Enterprise Market(GEM) to Main Board corporate action via automated channels such as HSBC Internet Banking?

Since the purchased shares are not yet settled and cannot be converted into the Main Board stock code after listing, you cannot place the sell order of the stock using the Main Board stock code via automated channels before settlement of the purchased share (on T+2). For assistance on placing sell order, please contact our Phonebanking Hotline for assistance.

What is the currency of Market Unit Price & Market Value?

The Market Unit Price & Market Value are in denomination currency of the stocks.

When will Stock Price Alert triggered?

Stock Price Alert will be triggered if Nominal Price of the selected HK stock reached the target price anytime in 9:20am to 4:10pm.

Risk disclosure:

Investment involves risk. You should carefully consider whether any investment products or services mentioned herein are appropriate for you in view of your investment experience, objectives, financial resources and relevant circumstances. The price of securities may move up or down. Losses may be incurred as well as profits made as a result of buying and selling securities.

For Renminbi (RMB) products:

- There may be exchange rate risks if you choose to convert RMB payments made on the securities to your home currency.

- RMB products may suffer significant losses in liquidating the underlying investments if such investments do not have an active secondary market and their prices have large bid / offer spreads.

- In general, RMB equity products are exposed to the usual kind of default risks that might be associated with equity products denominated in other currencies.

Back

|